glenwood springs colorado sales tax rate

The Colorado Avalanche Information Center has released its final more detailed report on the Jan. Colorados state sales tax is 29 percent on retail sales.

Glenwood Springs Colorado Sales Tax Rate Sales Taxes By City

Colorado has state sales tax of 29 and allows local governments to collect a local option sales tax of up to 8There are a total of 276 local tax jurisdictions across the state collecting an average local tax of 4079.

. Combined with the state sales tax the highest sales tax rate in Colorado is 112 in the cities. Click here for a larger sales tax map or here for a sales tax table. The avalanche killed Hannah.

9 avalanche that happened on North Star Mountain on Hoosier Pass. 12 and legislators have yet to hear a bill on the topic but lawmakers across the Western Slope are set to propose several. Kind Castle now has 10 retail store licenses in Colorado with 3 stores currently open in Parachute Nederland and Craig.

Issue 61 March 2004 Thematic Issue. Cerca nel più grande indice di testi integrali mai esistito. 1700 HourGlenwood Springs- Free Meals- Free Uniforms- Flexible SchedulesTEXT WEN12 TO 25000 TO APPLY Equipment Operator I or II - Eagle County - El Jebel Road and Bridge.

The Colorado income tax rate is a flat 455 percent of federal taxable income regardless of income level. End of April 2022 Town Treasurer - Town of Alma FULL-TIME TOWN TREASURERStarting at 40 - 50k DOE full benefits Health Life Vision and Dental Insurance PERA retirement Vacation and. Attendance at Colorado Mountain Medicals weekly vaccine clinics has also declined leading Lindley to believe that all county residents who want to be vaccinated have gotten the shot.

Glenwood Springs - Wendys NOW HIRINGCrew. Kind Castles 4th location is a retail cannabis superstore opening very soon in Commerce City closely followed by Ridgway and Glenwood Springs locations. Combined with the state sales tax the highest sales tax rate in New Mexico is.

As mountain towns across the state are grappling with how to regulate short-term rentals the Colorado Legislature is exploring multiple avenues to legislate the issue on a statewide level. The annual legislative session started Wednesday Jan. New Mexico has state sales tax of 5125 and allows local governments to collect a local option sales tax of up to 7125There are a total of 134 local tax jurisdictions across the state collecting an average local tax of 2257.

Full-year Colorado residents can claim an excess sales tax refund on their individual state income tax return. Click here for a larger sales tax map or here for a sales tax table. Shakespeare on Film in Asia and Hollywood.

We are hiring Front Desk agent from now until the end of the tax season approx. For Eagle County residents aged 16 to 19 as well as those aged 40 to 69 the county is reporting a vaccination rate of approximately 100 based on 2020 US. Tax is collected by the Colorado Department of Revenue.

Alabama Sales Tax Rates By City County 2022

Florida Sales Tax Rates By City County 2022

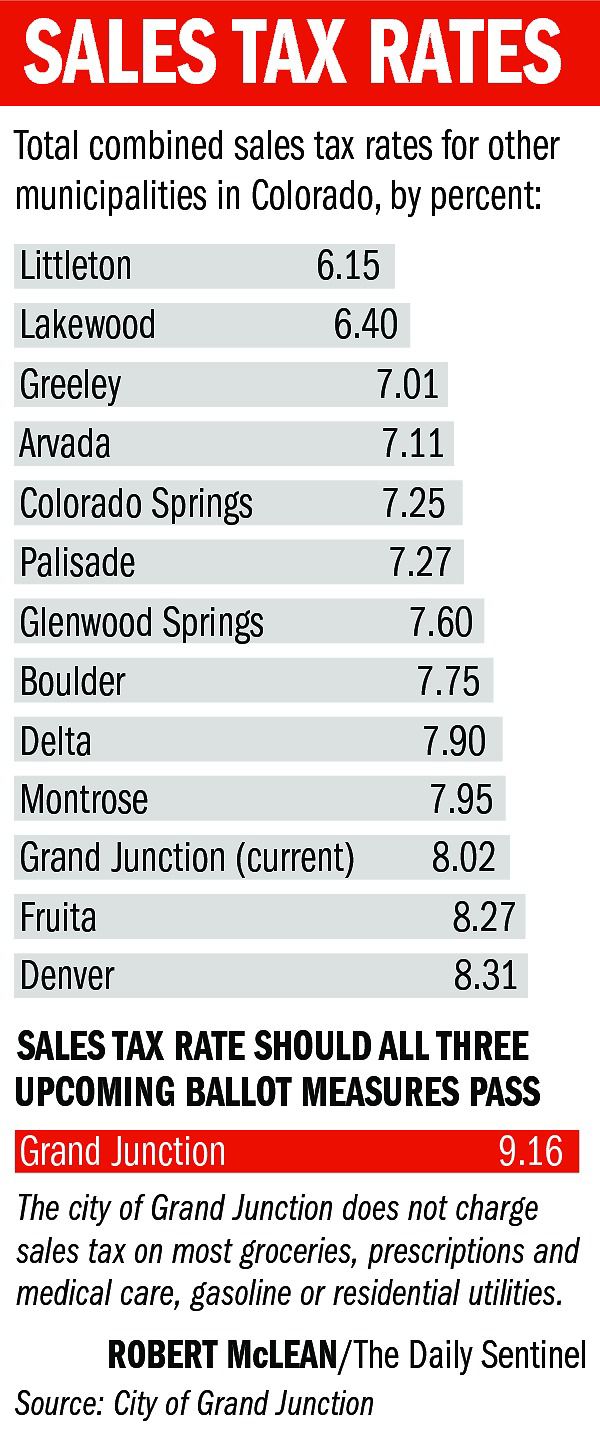

Gj S Combined Tax Rate Would Be Among State S Highest If Measures Pass Western Colorado Gjsentinel Com